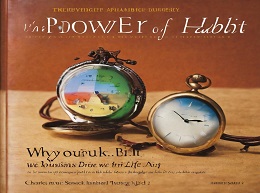

Thinking, Fast and Slow

"Thinking, Fast and Slow" is a book written by Daniel Kahneman, a Nobel Prize-winning psychologist and economist. Published in 2011, the book explores the two systems of thought that drive the way humans think: the fast, intuitive, and emotional system (System 1) and the slow, deliberate, and logical system (System 2). Here's a summary:

System 1: Fast Thinking

-

Intuition and Snap Judgments:

- System 1 operates automatically and quickly, allowing for rapid decision-making based on intuition and heuristics (mental shortcuts).

-

Associative Memory:

- It relies heavily on associative memory, linking ideas and concepts without the need for conscious effort.

-

Emotional Responses:

- System 1 is often influenced by emotional responses, leading to quick and sometimes biased judgments.

-

Pattern Recognition:

- This system excels at pattern recognition and is efficient in situations that do not require deep analytical thinking.

System 2: Slow Thinking

-

Analytical and Deliberate:

- System 2 involves more deliberate, conscious, and analytical thinking. It engages in problem-solving and critical reasoning.

-

Resource-Intensive:

- This system requires more mental effort and resources and is often slower than System 1.

-

Statistical Reasoning:

- System 2 is more likely to engage in statistical reasoning and consider a broader range of information.

-

Cognitive Effort:

- Complex tasks, logical reasoning, and activities that demand sustained attention involve System 2 thinking.

Key Concepts:

-

Availability Heuristic:

- Kahneman discusses the availability heuristic, where people rely on readily available information when making judgments, even if it might not be the most accurate or relevant.

-

Anchoring Effect:

- The book introduces the anchoring effect, where people's decisions are influenced by initial reference points, even if those points are arbitrary.

-

Prospect Theory:

- Kahneman and Amos Tversky developed prospect theory, which explains how individuals evaluate potential gains and losses.

-

Loss Aversion:

- Loss aversion, the idea that losses have a greater psychological impact than equivalent gains, is a central concept in the book.

-

Endowment Effect:

- The endowment effect, where people tend to assign higher value to things merely because they own them, is explored.

Impact:

-

Nobel Prize in Economics:

- Daniel Kahneman was awarded the Nobel Prize in Economics in 2002 for his groundbreaking work in behavioral economics, which influenced the concepts discussed in the book.

-

Influence on Behavioral Economics:

- "Thinking, Fast and Slow" has had a significant impact on the field of behavioral economics, challenging traditional economic models that assume perfectly rational decision-making.

-

Widespread Popularity:

- The book has become widely popular beyond academic and scientific circles, reaching a broad audience interested in understanding human decision-making.

-

Application in Various Fields:

- The concepts from the book are applied in diverse fields, including economics, psychology, business, and public policy.

"Thinking, Fast and Slow" provides valuable insights into the cognitive processes that influence decision-making. It has been praised for its accessible explanations of complex concepts and has influenced not only academic disciplines but also practical applications in various areas of life.